When it is about legal entities for business, two words typically come up: corporations and incorporations. Although they might appear similar, there are some important distinctions between the two. Knowing these distinctions is essential for business owners, entrepreneurs as well as anyone else involved in business.

We’ll explore the distinctions between corporate and incorporation, examining their definitions, features, and legal aspects, as well as their advantages and disadvantages. At the end of this course, you’ll have an understanding knowledge about these concepts and be prepared to make educated decisions regarding any business endeavors.

What is incorporation?

Incorporation refers to the process of legally creating and establishing a corporation as its own legal entity.

Here are a few key facts regarding incorporation:

1. Legal Formation: Establishing a corporation generally entails filing the necessary forms with state authorities to form it legally, with individual requirements and processes for incorporation varying depending on where your jurisdiction resides.

- Selecting and filing unique corporate names that abide by state requirements.

- Drafting and filing articles of incorporation that provide key details about their corporation such as name, purpose, registered agent, initial shareholders, and authorized stock.

- Paying fees and submitting the documents required by state authorities responsible for business registrations – for instance, the Secretary of State.

2. Separate Legal Entity: Once incorporated, a corporation becomes an independent legal entity distinct from its shareholders (shareholders). As such, it possesses its own rights, obligations, and legal responsibilities that stand separate from those held by shareholders – this allows it to enter contracts, own assets, sue/be sued as necessary, and engage in other business activities independently from them.

3. Limited Liability Protection: One of the main advantages of incorporation for shareholders is limited liability protection. Usually, shareholders do not personally have to assume liability for debts and legal obligations of their corporation if financial troubles or legal disputes arise; however, there may be exceptions, such as cases of fraud or illegal actions taking place within it.

4. Perpetual Existence: By incorporating, businesses gain perpetual existence – that is, they continue to exist and operate even after changes occur in ownership and management, independent from their founders’ lives or involvement – providing stability and continuity while also facilitating long-term planning and growth strategies.

5. Corporate Governance: Once established, corporations are subject to internal rules and regulations that they must adhere to. Often this involves creating a board of directors that oversees important decisions for the corporation as a whole and appointing officers responsible for day-to-day operations of it. Depending upon shareholder rights, shareholders have voting privileges on certain matters such as the election of directors and major corporate actions.

6. Corporate Name and Designation: Corporate incorporation often necessitates including specific designations in a company name to represent its legal standing as a corporation, depending on jurisdictional differences, such as “Inc.” or “Incorporated” (for instance ABC Corporation/XYZ Incorporated). Such symbols help distinguish corporations from other business entities while attesting to their legal structure.

Importantly incorporation requirements and regulations differ across jurisdictions; to make sure compliance with any specific needs when starting up a business is assured it’s wise to consult legal tax and government professionals prior to incorporation.

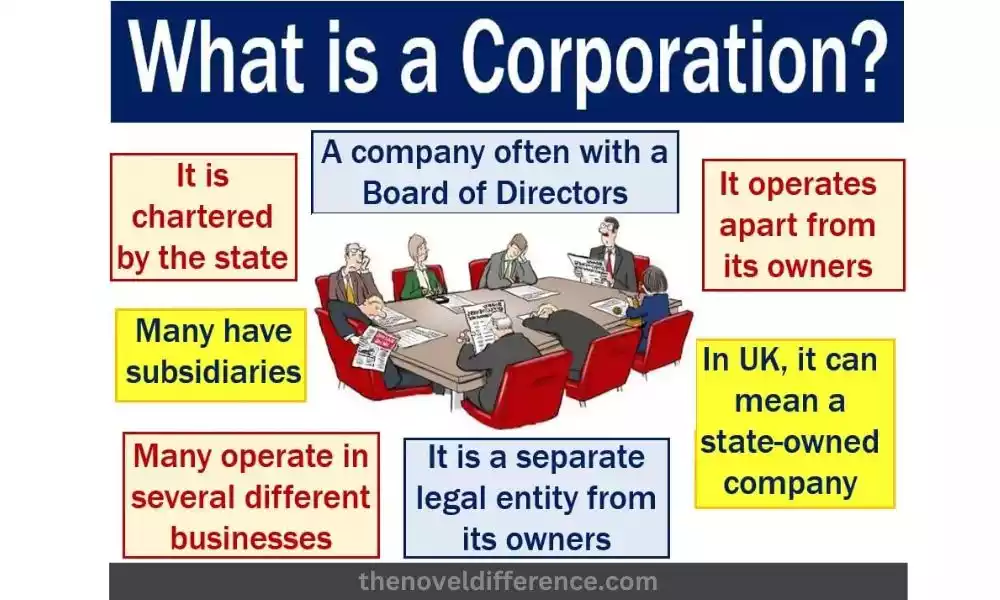

What is a corporation?

A corporation is a legal entity that stands apart from its shareholders or owners (known as shareholders). A corporation can be formed by filing all necessary documents with state authorities and meeting specific legal requirements.

Here are some key points about corporations:

- Legal Formation: Establishing a corporation involves selecting an original name, creating and filing articles of incorporation, and paying any applicable fees. Each state imposes additional regulations when creating corporations; typically, this involves designating an agent who acts as a registered agent and informs of purposes as well as initial shareholders/directors of your new venture.

- Limited Liability Protections: One of the primary advantages of incorporation is the limited liability protection it affords its shareholders. Typically, individual shareholders won’t be personally liable for debts and obligations of their corporation and, thus, are shielded against lawsuits or financial difficulties faced by it; although exceptions such as cases involving fraud may apply; certain other circumstances might warrant personal guarantees being required from shareholders as a condition for incorporation.

- Ownership and Management: Corporations have an established ownership structure: shareholders own shares of stock in the corporation to represent their own interests; this ownership can be freely transferred via buying and selling shares. A board of directors elected by shareholders governs each corporation; this board then appoints officers who run the daily operations of the organization.

- Taxation: C corporations, the most prevalent form of incorporation, are subject to corporate income tax rates and must file separate returns in order to pay these taxes at both levels – the profits are taxed at both corporate and individual income levels – meaning double taxation occurs for any dividends distributed as individual dividends also become subject to individual taxes; this double burden results in double taxation of same income but certain deductions, expenses or planning strategies may help ease their tax burden.

- Governance and Reporting Requirements: Corporations have specific governance and reporting obligations that they must fulfill, such as holding shareholder meetings at regular intervals and keeping proper corporate records such as meeting minutes and financial statements. In the Case of Publicly Traded Corporations, Additional Compliance Obligations exist, Including Filing Periodic Reports with the Securities Exchange Commission (SEC).

- Perpetual Existence: Corporations have perpetual existence, unlike sole proprietorships or partnerships which must dissolve upon changes in ownership or management – providing stability and continuity to your business operations.

- Capital Structure and Fundraising: Corporations have the advantage of issuing shares of stock to raise capital, and selling these to investors to generate funds for expansion, R&D projects, or any other activities a corporation needs for business operations. Being able to draw investors is invaluable when expanding and scaling a business.

Noting the various forms of corporations (C, S, and non-profit), each has unique requirements and characteristics; understanding these factors and regulations for your selected type is vital for its successful operation and compliance.

Differences between Corporation and Incorporation

The terms Corporation and Incorporation are closely related and often used interchangeably, but they have distinct meanings.

Here’s a breakdown of the differences between the Corporation and Incorporation:

1. Definition:

-

- Corporation: A corporation is a legal entity that is formed under specific laws and regulations. It is created to conduct business activities, and it is considered a separate legal entity from its owners or shareholders.

- Incorporation: It is the legal process of forming an organization. It involves filing the necessary documents and meeting the legal requirements to establish the corporation as a separate legal entity.

2. Focus:

-

- Corporation: The term “corporation” refers to the actual legal entity that exists as a separate entity from its owners. It can engage in various activities, such as conducting business, entering contracts, owning assets, and incurring liabilities.

- Incorporation: “Incorporation” focuses on the procedure or action of creating a company. It encompasses the steps taken to create the legal entity and give it certain rights, privileges, and responsibilities.

3. Legal Status:

-

- Corporation: A corporation has its own legal identity separate from its owners. It can sue or be sued, enter into contracts, acquire and sell assets, and be held liable for its actions.

- Incorporation: Incorporation is the act of legally forming a corporation. It involves filing documents with the appropriate government authority, such as articles of incorporation, and obtaining legal recognition for the entity.

4. Usage:

-

- Corporation: The term “corporation” is commonly used to refer to the legal entity itself. It can be used in various contexts, such as describing a company’s structure (e.g., multinational corporation) or its legal form (e.g., C corporation or S corporation).

- Incorporation: “Incorporation” is primarily used to describe the process of forming a corporation. It is used when discussing the legal steps involved in creating a separate corporate entity.

A corporation is a legal entity that exists separately from its owners, while incorporation is the process of forming that legal entity. Corporation refers to the entity itself, while incorporation refers to the act of creating it.

Importance of Understanding the Difference Between Inc. and Corp.

Understanding the difference between corporations and Inc.

Important for both individuals and businesses for various reasons:

- Legal Compliance: Each legal structure imposes different compliance obligations on its constituents, so understanding them allows individuals to ensure they fulfill all required legal responsibilities such as filing annual reports, holding shareholder meetings, and adhering to corporate governance standards. Failing to abide by them could incur fines or the suspension or withdrawal of legal protections.

- Liability Protection: One of the main draws to incorporation is limited liability protection it affords shareholders’ personal assets from debts and liabilities of a corporation; this level may differ between types of corporations; understanding this can help individuals determine if their personal assets are adequately shielded.

- Tax Implications: Understanding tax implications is another vital element. C corporations face double taxation where profits of both the corporation are subject to taxes while dividends received are taxed again as dividends received by shareholders; S corporations or certain forms of Inc companies allow pass-through taxation so profits or losses from company operations pass directly through to individual shareholder’s personal returns and can thus help individuals make informed decisions regarding their own personal planning or savings opportunities.

- Ownership and Management Structure: Corporations and Inc. companies may differ when it comes to ownership and management structures. Usually, corporations feature shareholders with shares who own stock owned by a corporation as well as directors overseeing strategic decisions of that business entity; Inc. companies may have shareholders but their exact structure could depend on both its jurisdictional location as well as a specific entity within it. Being aware of these variations allows individuals to select an ownership and management arrangement that fits with their desired preferences for optimal ownership/management arrangements.

- Perception and Credibility: Choosing the appropriate legal structure for a business can have a substantial effect on its perception and credibility in the marketplace. Some may associate corporations with larger, established entities while Inc companies might be perceived by some individuals as smaller startups with limited success or potential. Understanding such perceptions helps individuals make informed decisions that align with their branding, marketing efforts, and long-term goals.

Understanding the differences between corporations and Inc. companies is vitally important for legal compliance, liability protection, tax planning, ownership/management decisions, and overall business perception/credibility. Knowledge Empowers People to make Well-Informed Choices That best Match their Specific Needs and Goals.

Which One to Choose Corporation and Incorporation?

When making the choice between incorporation and corporation formation, it’s essential to realize that incorporation simply refers to the act of creating one legal entity versus another – not between corporations and incorporations but among various legal forms like sole proprietorships, partnerships, or limited liability companies (LLCs).

Here are a Few Factors to Keep in Mind When Making the Choice Between Incorporation and Alternative Structures:

- Limited Liability Protection: Corporations offer limited liability protection to shareholders, meaning they typically won’t personally have to bear responsibility for their debts and obligations. If shielding personal assets from potential business liabilities is paramount for you, choosing a corporation could be your ideal solution over other forms of business entity formation.

- Taxation: Consider the tax implications associated with each business structure you consider. Corporations (especially C corporations) can face double taxation as both profits are subject to corporate income taxes while shareholder dividends receive tax treatment as dividends received; other structures like LLCs or S corporations allow pass-through taxation, where profits and losses flow directly back into personal tax returns of owners; consulting a professional tax adviser can assist in finding out which structure best serves your needs and circumstances.

- Ownership and Management: Evaluate the desired ownership and management structures for your business, from corporations that involve shareholders, directors, and officers to sole proprietorships or partnerships that offer more flexible forms of management with simpler control structures like sole proprietorships or partnerships – consider your desired level of control over decision-making power as you make this choice.

- Compliance Requirements: Understand your ongoing compliance obligations as part of each business structure. Corporations often have more formalities and reporting obligations associated with them – for instance, holding annual meetings, maintaining minutes, and filing annual reports – while other structures might entail lower compliance burdens.

- Funding and Investment: When raising capital or seeking investors, corporations often prove more suitable. Their structure enables the issuance of shares of stock to make fundraising simpler than with other structures which might limit you from reaching investors directly.

- Long-Term Goals: Consider your long-term business objectives when making this decision. If your plans involve significant expansion or possible public offerings in the future, incorporation may provide the scalability and solid legal infrastructure you require for long-term growth and expansion.

As your company’s choice of business structure will depend on many variables — its nature and goals being key factors here — it’s wise to consult a legal and tax professional so as to gain full insight and make informed decisions tailored to your unique circumstances.

Conclusion

Understanding the differences among various Business structures such as Corporations and other forms of legal entities is integral when setting up and running your own company. Although incorporation or incorporation isn’t an option that is 100, it’s important to keep certain aspects in mind when choosing an appropriate form to meet your company’s requirements.

Factors to take into consideration for selecting an entity structure are liability protection, taxation, ownership/management preferences, compliance obligations, funding/investment strategies, and long-term goals. With these in mind, consider which is most suited for your business: an LLC or a corporation.